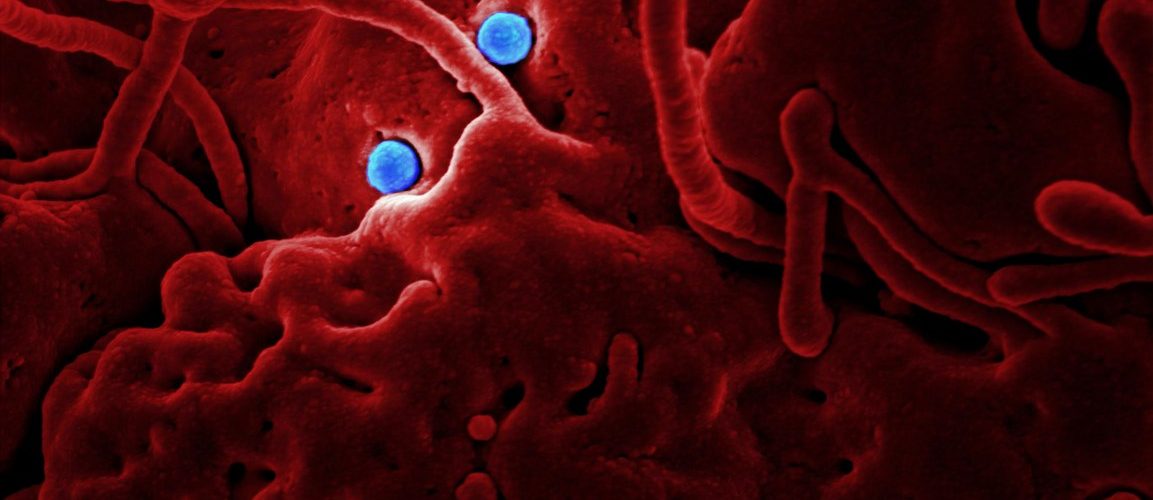

HMRC has announced a relief which allows for certain goods, including medical equipment, crucial to the fight against coronavirus, to be imported free of VAT and customs duties. In addition, in the case of Pfizer (Case C-182/19) the CJEU has held that an EU Directive applying a tariff to certain medical equipment (instead of exempt treatment) is void.

Source: mazars.com

Latest Posts in "United Kingdom"

- UK VAT Rules on Online Prize Draws Face Scrutiny Amid New Voluntary Code and Industry Growth

- How UK Businesses Accidentally Trigger US State Sales Tax Through Ecommerce and Economic Nexus

- Director Liable for VAT Fraud and PAYE/NIC on Withdrawals: Ellis & Anor v HMRC (2026)

- UK VAT Gap Rises to £11.9bn in 2024–25, HMRC Reports 6.5% Shortfall

- Luzha v HMRC: VAT Late Submission Penalties Upheld, No Reasonable Excuse Found, Appeal Dismissed