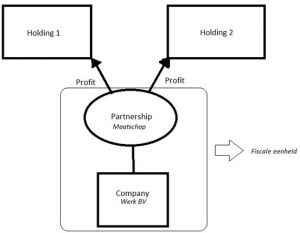

As you may know, since 2018, the Tax Authorities no longer issues VAT group (Fiscale eenheid) between a maatschap (partnership) and a BV (company) in the situation described below where Holding 1 and Holding 2 have contributed the economic ownership of shares in Werk BV to the maatschap (partnership).

According to the Tax Authorities, a VAT group between the maatschap (partnership) and Werk BV is not possible because the financial interdependence requirement has not been met. This is not in line with our experience that in the past the Tax Authorities did issue a VAT group in the situation described above. In connection with an ongoing objection procedure with the Tax Authorities, we would particularly appreciate it if you would like to share with us the experience that, in the situation described, the Tax Authorities in the past issued a VAT group decision between the maatschap (partnership) and Werk BV.

We are looking for statements from advisors who can confirm that the Tax Authorities in the past (the period 2000 to 2017) accepted a VAT group in the situation described above. We would greatly appreciate it if you are willing to deliver decisions on the subject of the acceptance of the VAT group, in situations like above.

We hereby expressly state that anonymity is offered to your client(s).

We would like to receive your response before 1 March 2020, for which we thank you in advance. In exchange for information provided, we will keep you informed of developments.

If you have any questions, you can always contact Carola van Vilsteren ([email protected]).

She is best reachable on her mobile telephone number +316-51232201 or her office number +3185- 0403222.