On February 21, 2018, the ECJ issued its judgment in the Case C‑628/16 (Kreuzmayr GmbH).

Context: Reference for a preliminary ruling — Taxation — Value added tax (VAT) — Successive supplies relating to the same goods — Place of the second supply — Information provided by the first supplier — VAT identification number — Right to deduct — Legitimate expectation on the part of the taxable person regarding the existence of the conditions giving rise to the right to deduct

Summary

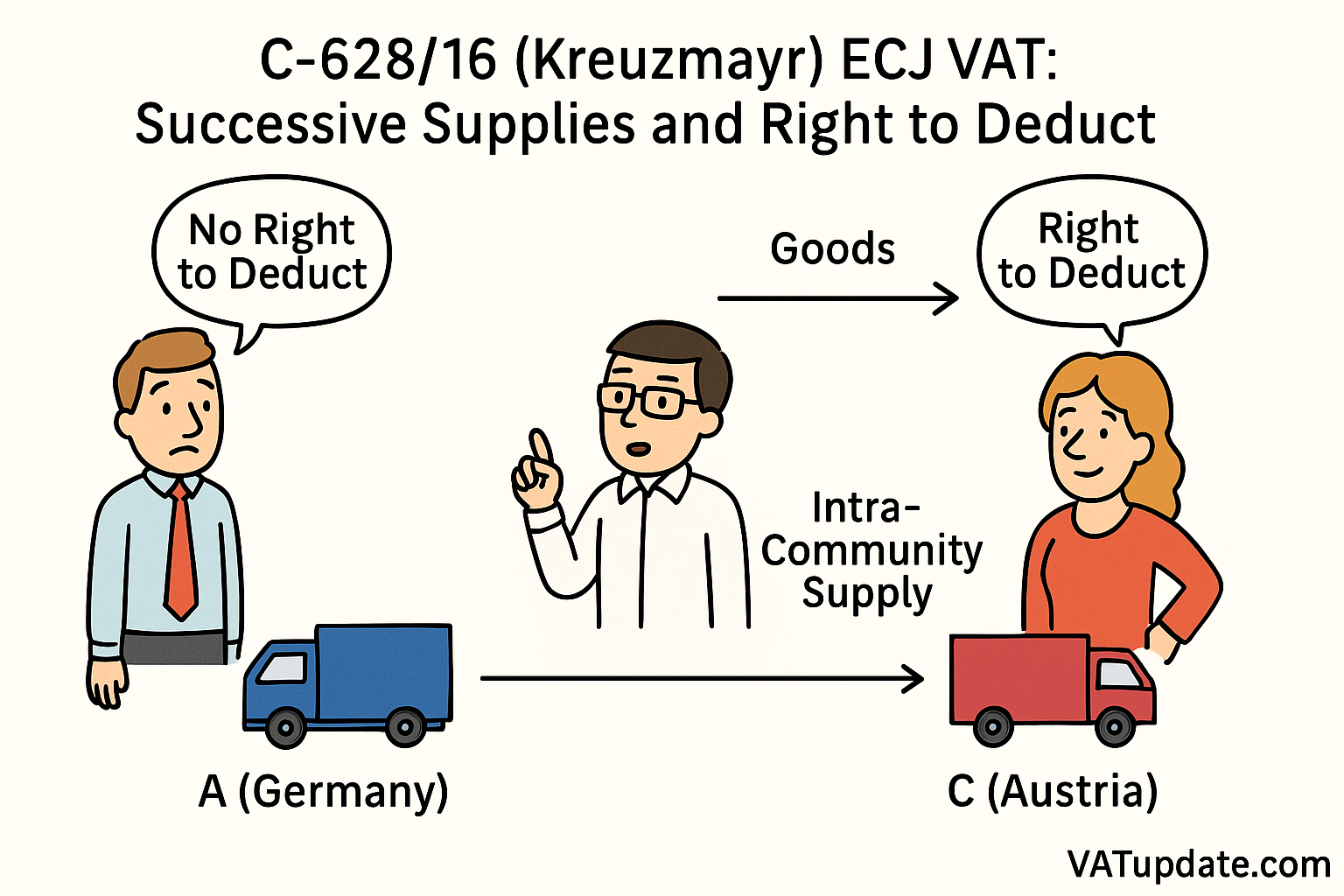

- Case Background: The case (C‑628/16) involves Kreuzmayr GmbH challenging the Linz Tax Office’s decision to cancel its input VAT deduction for transactions related to petroleum products, following a series of supplies involving intermediaries and the misclassification of VAT statuses. The case was referred to the Court of Justice of the European Union (CJEU) by the Bundesfinanzgericht (Federal Finance Court, Austria) for clarification on VAT law.

- Key Questions to the Court: The court was asked to clarify whether the VAT Directive’s provisions apply to the first or second supply in a series of successive supplies involving intra-Community transport and whether the principle of legitimate expectations allows for VAT deductions based on misclassified invoices from suppliers.

- Court’s Decision on VAT Supply Classification: The CJEU ruled that the first paragraph of Article 32 of the VAT Directive applies specifically to the second of two successive supplies of the same goods that give rise to a single intra-Community transport, indicating that the classification of the supply should depend on the actual circumstances of the transactions.

- Right to Deduct VAT and Legitimate Expectations: The court concluded that the ultimate purchaser (Kreuzmayr) could not claim input VAT deductions based solely on incorrect invoices from the intermediary supplier (BIDI), as the right to deduct is contingent upon the correctness of the tax classification of the transaction.

- Outcome and Implications: The ruling emphasizes that the right to deduct VAT is strictly governed by the actual tax obligations and cannot be based on erroneous classifications. This judgment underscores the importance of accurate VAT reporting in successive supply chains, reinforcing the need for businesses to ensure compliance with VAT regulations to maintain their deduction rights.

Articles of the EU VAT Directive 2006/112/EC

- Article 32: This article defines the place of supply for goods that are dispatched or transported. It specifies that the place of supply is deemed to be the location of the goods at the time when the dispatch or transport begins. This article is central to determining whether the supply in question qualifies as an intra-Community supply.

- Article 138(1): This article provides the exemption for the supply of goods dispatched or transported to a destination outside the Member State of the supplier, provided specific conditions are met, including the involvement of a taxable person.

- Article 167: This article establishes the point in time when the right to deduct VAT arises, stating that the right arises when the deductible tax becomes chargeable.

- Article 168(a): This article outlines the conditions under which a taxable person can deduct VAT incurred on supplies received, linking the right to deduct to the purpose of the goods or services being used for taxed transactions.

Facts and Background

- BP Marketing GmbH (DE) sold petroleum products to BIDI Ltd (AT VAT ID #). BIDI agreed to order and arrange the transport of those products from DE to AT. Without informing BP Marketing, BIDI resold the goods to Kreuzmayr, agreeing that Kreuzmayr would order/arrange the transport of the goods from DE to AT, which Kreuzmayr did.

- BP Marketing treated its supplies to BIDI as intra-Community supplies. BIDI treated its supplies to Kreuzmayr as local sales in AT, charging AT VAT, which VAT Kreuzmayr subsequently recovered.

- When BP Marketing found out that BIDI had resold the products, and did, in fact, not transport the goods, BP Marketing reissued its invoices to BIDI, charging DE VAT. BIDI sent amended invoices to Kreuzmayr without VAT. However, BIDI did not repay the wrongly charged AT VAT to Kreuzmayr. BIDI went bankrupt, and Kreuzmayr never recovered the amounts of VAT which it had paid to BIDI.

- The AT tax authorities raised an assessment with Kreuzmayr, arguing that the VAT on the original invoices from BIDI was wrongly charged, and was thus not deductible.

- The ECJ repeats that there can be only 1 Intra-Community supply, which is the chain in which the transportation takes place. This is the transaction where the right to dispose of the goods as owner takes place.

- In this case, Kreuzmayr was the owner of the goods before the intra-Community transport took place. This means that the intra-Community transport must be ascribed to the second supply.

- Kreuzmayr could/should also have known or realized this, and can therefore not claim back any (wrongly) charged VAT.

Questions

(1) In circumstances such as those at issue in the main proceedings,

- in which a taxable person X1 has at its disposal goods stored in Member State A and has sold those goods to a taxable person X2, and X2 has expressed to X1 its intention to transport the goods to Member State B, and X2 has presented to X1 its VAT identification number issued by Member State B,

- and X2 has sold those goods on to a taxable person X3 and X2 has agreed with X3 that X3 will arrange or carry out the transport of the goods from Member State A to Member State B and X3 has arranged or carried out the transport of the goods from Member State A to Member State B and X3 was already entitled to dispose of the goods as owner in Member State A,

- and X2 has not, however, informed X1 that he has already sold on the goods before they leave Member State A,

- and X1 also could not know that X2 would not be arranging or carrying out the transport of the goods from Member State A to Member State B,

- is EU law to be interpreted as meaning that the place of supply from X1 to X2 is determined in accordance with the first paragraph of Article 32 of the VAT Directive and that the supply from X1 to X2 is thus the intra-Community (the so-called “active”) supply?

(2) If Question 1 must be answered in the negative, is EU law then to be interpreted as meaning that X3 may nevertheless deduct as input VAT an amount of VAT of Member State B invoiced to it by X2, provided that X3 uses the goods purchased for purposes of its transactions taxed in Member State B and no wrongful exercise of the right of deduction of input VAT can be imputed to X3?

(3) If Question 1 must be answered in the affirmative and X1 subsequently learns that X3 has arranged the transport and was already entitled to dispose of the goods as owner in Member State A, is EU law then to be interpreted as meaning that the supply from X1 to X2 retrospectively loses its status as the intra-Community supply (that it is thus to be viewed retrospectively as a so-called “passive” supply?’

AG Opinion

None

Decision

1. In circumstances such as those in the main proceedings, the first paragraph of Article 32 of Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax must be interpreted as meaning that it applies to the second of two successive supplies of the same goods which gave rise to only one intra-Community transport.

2. Where the second supply in a chain of two successive supplies involving a single intra-Community transport is an intra-Community supply, the principle of the protection of legitimate expectations must be interpreted as meaning that the person ultimately acquiring the goods, who wrongly claimed a right to deduct input value added tax, may not deduct, as input value added tax, the value added tax paid to the supplier solely on the basis of the invoices provided by the intermediary operator which incorrectly classified its supply.

Source

Briefing document & Podcast

Newsletter

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

Latest Posts in "European Union"

- EESC Opinion: EPPO and OLAF Access to EU-Wide VAT Data to Combat Fraud

- General Court Confirms Dual VAT Liabilities Possible for Incorrect Invoicing of Intra-Community Supplies

- CJEU Rules ‘Financing’ Not Exempt in VAT Assessment of Factoring Transactions in Kosmiro Case

- Understanding the VAT Gap: Impact on Global Compliance, Business Operations, and Digital Tax Reforms

- EU Court Clarifies VAT Exemption Rules for Cost-Sharing Groups in Healthcare and Education Sectors