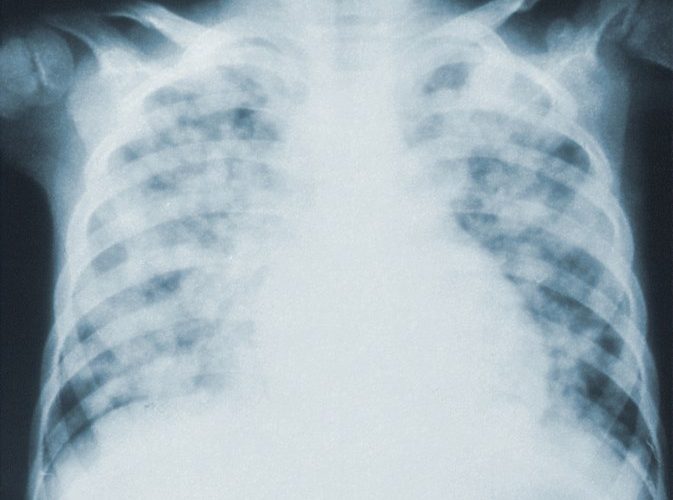

The complaint was due to the fact that the Danish Tax Agency had answered “No” in a binding answer to whether a company’s supply of full-body MRI scans was exempt from VAT according to Section 13, subsection of the VAT Act. 1, no. 1. The National Tax Court noted that what was decisive for the qualification under VAT law was the nature of the service provided and that the persons who had to provide the intended services, including radiographers and specialist doctors, had the required professional qualifications. The National Tax Court thus had to decide whether the intended services could be qualified under VAT law as “treatment of persons”. The National Tax Court assumed that the services provided by the company in the form of full-body MRI scans were aimed at customers, who, according to a medical assessment, had shown special indications of health risks for diseases or health anomalies. After an overall concrete assessment, the National Tax Court found that the delivery of the intended services consisting of full-body MRI scans was covered by the concept of “other actual health care”, cf. VAT Act section 13, subsection 1, no. 1. The National Tax Court took particular account of the fact that the main purpose of the benefits was to prevent and possibly diagnose illnesses and health irregularities, so that serious illnesses, such as cancer, could be diagnosed early in the process and treated. In this connection, the National Tax Court found it irrelevant to the VAT exemption whether the full-body scans showed that the customers did not suffer from an illness or health irregularity, in view of the underlying purposes of the provision. The National Tax Court then changed the Tax Agency’s answer to the question to a “Yes”.

Source: skat.dk