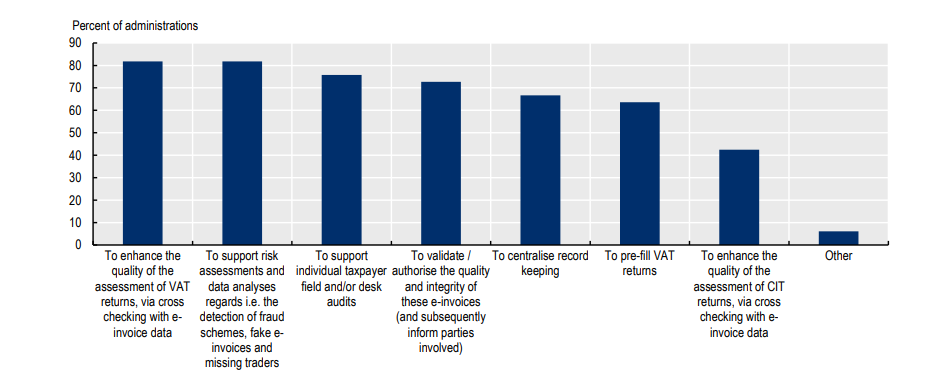

Below Figure out of 2020 report ”OECD Tax Administration 3.0 and Electronic Invoicing Initial Findings” published on September 28, 2022 presents a wide variety of compliance management related purposes for tax administrations to collect e-invoice data. Compliance levels might be increased via, among others:

- incentives to businesses to invest in the quality of business (reporting) systems (upstream compliance);

- deterrent effect on voluntary compliance;

- more effective and timely detection of fraudulent traders;

- enhancing the quality of audit selection and the audit execution itself.

Source OECD