Context

- The European Commission will launch its proposal on ViDA on December 7, 2022

- ViDA is not only about Digital Reporting Requirements (E-Invoicing and Real Time Reporting), it is also about Single EU VAT Registration and the Platform Economy

- The EU Member States will need to approve the proposal before it can be implemented in the European Union. Hence, changes to the proposal may still be possible.

- Some countries are however waiting for the proposal to implement mandatory E-Invoicing and Real Time Reporting in their country just to ensure it is aligned with the EU proposal

Digital Reporting requirements: the proposal

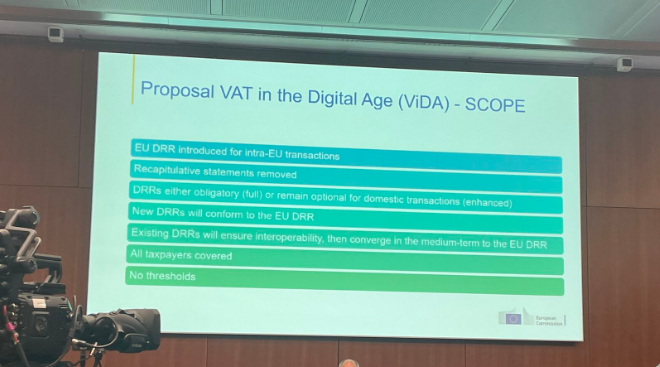

- Digital Reporting Requirements will be introduced for intra-EU (B2B) transactions.

- This will include (1) mandatory E-Invoicing for intra-EU transactions and (2) (near) real-time reporting of e-invoicing data.

- Both supplier and customer will need to submit data to a central database.

- Member States will going forward no longer need to apply for a derogation in order to introduce mandatory B2B e-invoicing.

- There will be no thresholds or exemptions.

The good news …

- The reporting requirement will replace the current intra-community listings

Quid domestic transactions

- Implementation of Digital reporting requirement also for domestic transactions will be optional

- A mandate for domestic transactions may be possible later

- New Digital Reporting Requirements will need to dollow the EU model

- The new system will need to ensure interoperability with current E-Invoicing and Real Time Reporting Requirements

- At medium term, current systens will need to be converged to the EU model.

- The EU Standard for Electronic Invoicing (EN16931) will be used for digital reporting and potentially further adapted.