Status October 5, 2022

Scroll to the right for more info

Click on the name of the country to see more info

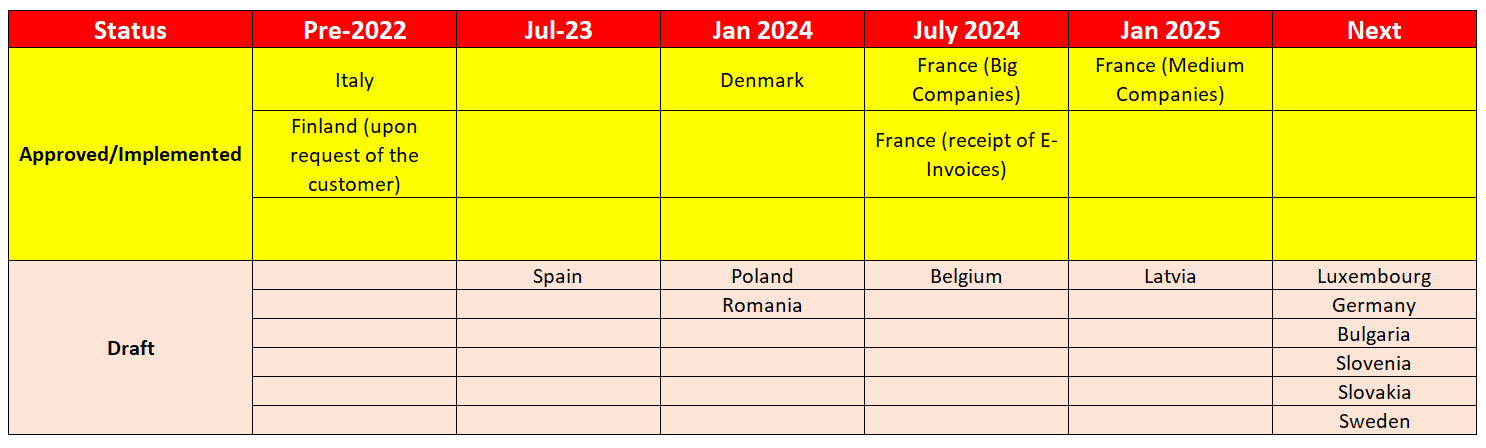

| Country | Status | Category | Legislative change | |

| Starting date | ||||

| Belgium | Approved | E-Invoicing | Mandatory B2G E-Invoicing as of Sept 1, 2022 | 01/09/22 |

| Belgium | Draft | E-Invoicing | Mandatory B2B E-Invoicing, gradual implementation, to be approved by EU Commission | 01/07/24 |

| Bulgaria | Draft | E-Invoicing | A public consultation on mandatory B2B e-invoicing is planned, as well as proposals for introducing SAF-T reporting | |

| Bulgaria | Draft | SAF-T | A public consultation on mandatory B2B e-invoicing is planned, as well as proposals for introducing SAF-T reporting | |

| Denmark | Approved | E-Invoicing | Mandatory B2B E-Invoicing based on bookkeeping Act, detailed requirements published | 01/01/24 |

| Egypt | Approved | Real Time Reporting | From January 2023, electronic tax invoices will be requested to be uploaded instantly (in real time). This decision implementation is spread over 6 months and the grace period is reduced day by day in each month. As of October 2022, invoices must be uploaded to the tax office within 3 days | 01/10/22 |

| France | Approved | E-Invoicing | Gradual implementation as of July 1, 2024 of mandatory B2B E-Invoicing: 1 Jul 2024 for large companies (more 5,000 employees; and either of following: €1.5 billion turnover; or €2 billion balance sheet) 1 Jan 2025 for medium sized companies 1 Jan 2026 for small businesses (less than 250 employees; and not exceeding either of following: €50 million turnover; or €43 million balance sheet) |

01/07/24 |

| France | Approved | Real Time Reporting | Gradual implementation as of July 1, 2024 of Real Time Reporting B2B and B2C (decentralized clearance model) | 01/07/24 |

| France | Approved | E-Invoicing | Obligation to receive invoices in electronic format will be started for all taxpayers | 01/07/24 |

| Hungary | Draft | SAF-T | Hungary plans to implement SAF-T reporting in late 2022/early 2023 | |

| Italy | Approved | E-Invoicing | Electronic invoicing: new technical specifications have been published which can be used from 1 October 2022 | 01/10/22 |

| Latvia | Draft | E-Invoicing | Mandatory B2B and B2G E-Invoicing, EU Commission approval needed | 01/01/25 |

| Luxembourg | Approved | E-Invoicing | B2G e-invoicing mandate: Second phase (Medium Size Companies) starting October 18, 2022 | 18/10/22 |

| Luxembourg | Approved | E-Invoicing | B2G e-invoicing mandate: Third phase (Small and newwly created businesses) starting March 18, 2023 | 18/03/22 |

| Poland | Approved | E-Invoicing | Optional B2B E-Invoicing | 01/01/22 |

| Poland | Draft | E-Invoicing | Mandatory B2B E-Invoicing | 01/01/24 |

| Portugal | Approved | Invoicing | The mandatory inclusion of ATCUD codes, which is a unique document identification number, will be efffective January 2023 | 01/01/23 |

| Romania | Draft | E-Invoicing | Mandatory B2B E-Invoicing, to be approved by EU Commission, implementation in 2023? | |

| Romania | Approved | E-Invoicing | Romania Makes E-Factura Electronic Invoicing System Mandatory for B2G Transactions as of July 1, 2022 | 01/07/22 |

| Romania | Approved | E-Invoicing | Mandatory B2B E-Invoicing for high risk products | 01/07/22 |

| Slovakia | Draft | E-Invoicing | Plan to introduce mandatory B2B E-Invoicing, EFA test will start as of December 1, 2022 | |

| Slovenia | Plan | E-Invoicing | Slovenia has announced plans to introduce B2B e-invoicing. | |

| Spain | Approved | E-Invoicing | Mandatory B2B E-Invoicing. Timings to be confirmed. Q3 2023 for business with turnover exceeding 8 million EUR. Q4 2024 for other businesses. | Q4 2023/Q4 2024 |

| Sweden | Draft | Real Time Reporting | Swedish tax authority has started work on three different types of reporting(E-Invoicing, RTR, SAF-T) |

See also