WU Global Tax Policy Centre – EU Questionnaire on cross-border VAT disputes to provide input to the EU Commission for their legal initiative to prevent and resolve VAT disputes (EU COMMISSION VAT ACTION PLAN)

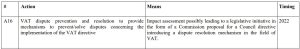

Source ACTION PLAN FOR FAIR AND SIMPLE TAXATION SUPPORTING THE RECOVERY STRATEGY

Background

Unresolved cross-border VAT disputes distort trade flows within the EU and can influence the location decisions of companies. At the same time, they divert the resources of tax administrations away from improving the operation of VAT systems. This is why the European Commission (EC) is considering launching work to assess the size of the problem and potential solutions. This is the context in which WU Global Tax Policy Centre (hereafter WU GTPC) has launched a multi-stakeholder initiative to explore the causes of such disputes, the current mechanisms available to minimise and resolve them and what new options are open to the European Union. This exercise is part of a global initiative, which was launched last year. A preliminary analysis of the responses to the 2021 questionnaire provided by over 60 respondents from business and government is available at the link provided. The aim of this latest request for information is to provide a sound factual basis focused on helping the EC decide on whether it wishes to take forward this work.

The Questionnaire is intended to collect data from businesses, business federations, tax advisors, lawyers, other experts and academia to obtain insights into cross-border VAT disputes in the EU. This would allow us to assess the scale of the problem, identify the root causes of cross-border VAT disputes with the goal of suggesting solutions to reduce the number of cross-border VAT disputes through prevention and resolution mechanisms.

The questionnaire can be accessed and completed through this link.

Disputes in the context of this survey refers to disagreements between tax administrations and taxpayers on the interpretation and application of the legislation or on the relevant facts. In some cases, the taxpayer may decide not to pursue a disagreement into a formal litigation process for different reasons because this would be e.g., too costly, too time consuming given the amount of tax at stake or where they feel it may adversely influence their relationship with the tax administration. A number of questions in Part II of the questionnaire request information on these types of disagreements. The WU GTPC are reviewing cross border VAT disputes that can be bilateral, trilateral or maybe even multilateral. Bilateral cross border VAT disputes are between one taxable person and one tax authority. There is a bilateral cross border dispute in the EU when there is a dispute between a tax administration of an EU Member State and a taxable person not established in the Member State where the dispute occurs. The taxable person can be established in another Member State or outside of the EU (EU-EU or non-EU-EU). Examples are disputes on the applicable VAT rate for a supply of goods in that Member State, on an EU VAT refund or a 13th Directive VAT refund etc. Trilateral cross-border VAT disputes are between a taxable person and two tax authorities of two different countries. There is a trilateral dispute in the EU, when there is a dispute between a taxable person and two tax administrations of two different member states (MS1 and MS2). The taxable person can be established in one of those two Member States (MS1 or MS2) or in another Member State (MS3) or outside of the EU.

All responses will be treated strictly confidential and all replies are anonymous. You are kindly requested to complete and submit the questionnaire by 31 May 2022.

For any further details on the questionnaire, please kindly contact Jeffrey Owens ([email protected]), Ine Lejeune ([email protected]) or the WU Global Tax Policy Center ([email protected])