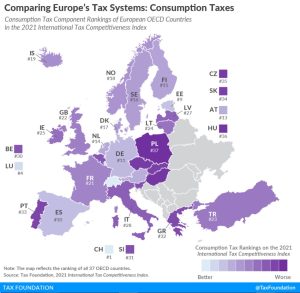

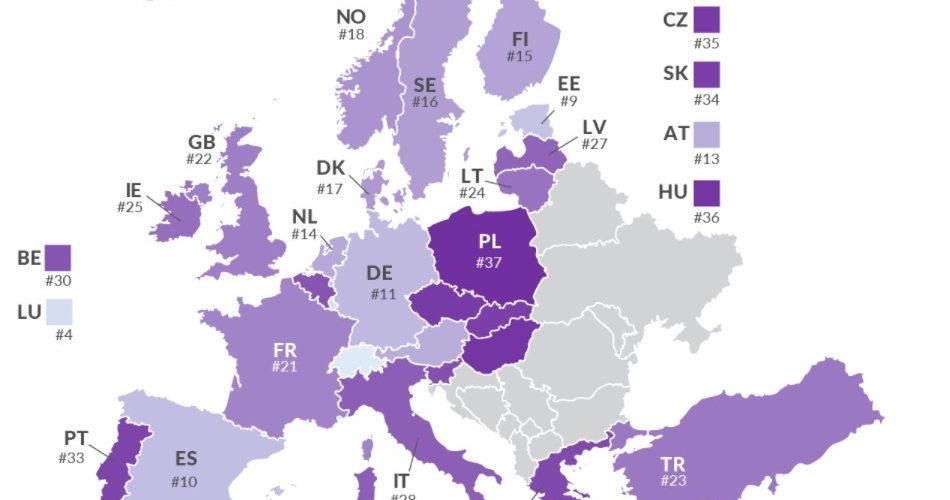

According to our Index, Switzerland has the best-structured consumption tax among OECD countries. At a rate of 7.7 percent, Switzerland levies the lowest VAT rate of all European OECD countries. (The United States has the lowest sales tax rate in the OECD at an average of 7.4 percent.) The Swiss VAT is levied on 70 percent of final consumption, making it the OECD country with the fifth broadest consumption tax base. Switzerland’s VAT is the easiest to comply with among OECD countries, requiring on average only eight hours a year in compliance time.

Poland’s VAT, by contrast, is characterized by a high rate (23 percent), relatively narrow base (51 percent of final consumption), and high complexity (172 hours annual compliance time). As a result, Poland ranks last in the ITCI’s consumption tax component.

Source Tax Foundation