New OTA VAT Guide

The Omani Tax Authority has released a new VAT guide regarding Special Economic Zones (SEZs).

The guide kicks-off by listing the recognized SEZs in the Sultanate, which are: Al-Mazunah Free Zone, Suhar Free Zone, Salalah Free Zone and the Special Economic Zone at Duqm.

The guide stipulates the VAT treatment of supplies of goods and services from/to SEZs and includes some special requirements for the application of the Zero rate for goods/services received by an entity operating in a SEZ:

– Customer is Taxable person

– Customer must be licensed by the authority operating and supervising the SEZ/FZ

– Customer must receive the goods/services for the purposes of the activity within the SEZ/FZ

– Services do not include services stipulated in Article (24) of the Law

– Services not exempt from tax in accordance with the provisions of Article (47) of the law

– Customer must sign and provide the supplier with a declaration confirming that he is licensed by the supervising authority of the SEZ and that he has received the goods/services for the purposes of his activity within the SEZ.

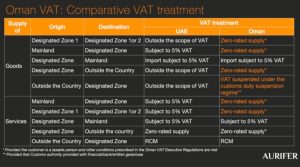

Below we differentiate between the FZ VAT treatment in the UAE and Oman. It is going to be interesting to observe ZATCA’s approach in light of the recent talks about the introduction of Free Zones in KSA.

Source Thomas Vanhee /Aurifer