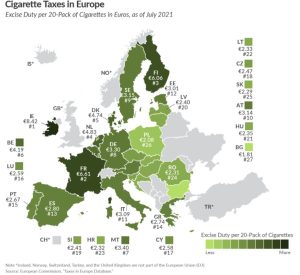

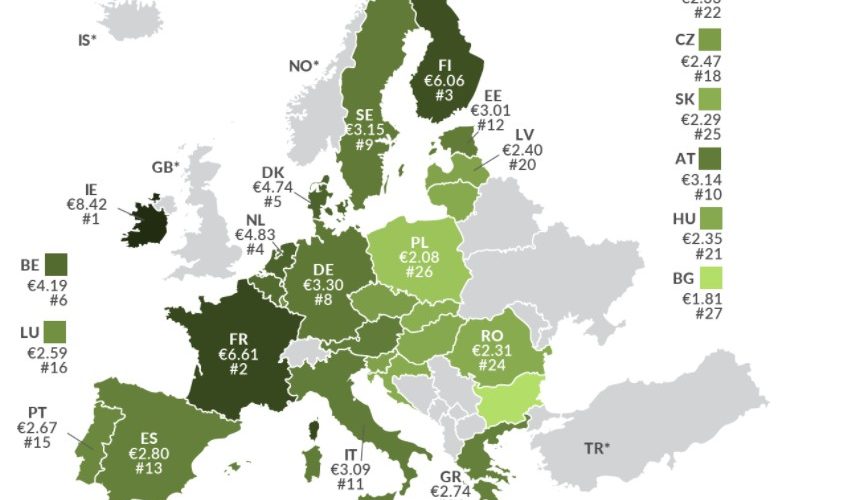

To ensure the functioning of its internal market, the European Union (EU) sets a minimum excise duty on cigarettes. It consists of a specific component and an ad valorem component, resulting in a minimum overall excise duty of €1.80 (US $2.05) per 20-cigarette pack and 60 percent of an EU country’s weighted average retail selling price (certain exceptions apply). As this map shows, most EU countries levy much higher excise duties on cigarettes than legally required.

Source