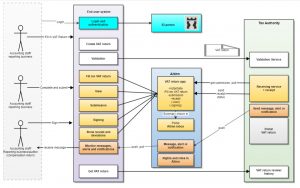

The MEMO-project is developing a new tax return for VAT compensation (VAT return). The goal of the MEMO-project is to achieve increased compliance, equal competitive conditions, simplification for reporting businesses, and a more effective administration of the VAT system. Some simplification is a result of changes in the VAT return; fever sources of errors, easier returns, and making it easier to fulfil the duty to provide information. A new VAT return will also provide new opportunities for guidance and dialog through validation before submission, and reminders for tasks. In addition, it will be possible to offer an increased degree of access to information to achieve effectiveness and safety through digital reconciliation of the VAT return. There is also a desire for better interaction between accounting/ERP systems and Altinn/Tax Authority systems, for example automatic receipt for submitted VAT returns.

Source Skatteetaten

Latest Posts in "Norway"

- Norway Proposes New VAT Timing Rules for Cross-Border Remotely Deliverable Services: Comments Invited

- Altinn Launches Email Login to Improve Access for Users Without Norwegian National ID Number

- New VAT Compensation Rules for Camp Schools: Clarification from the Tax Directorate

- VAT Exemption for Canteen Contributions: New Clarifications for Employers and Providers

- Norway Clarifies VAT Rules for Transferring Development Projects to SPVs Not VAT-Exempt